One of the ways to get quick loan in Nigeria is through FairMoney.

One of the ways to get quick loan in Nigeria is through FairMoney.

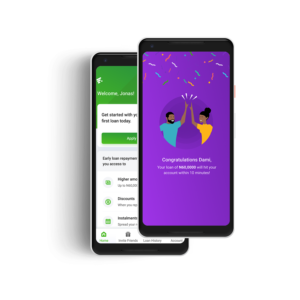

FairMoney is a leading FinTech company in Nigeria that has a license to give loans. It gives instant loans to people in Nigeria without collateral.

fine monkey has continued to earn respects from Nigerians ever since its entrance into the lending sector.

They have positive reviews from users thereby making it the best choice when it comes to loans.

You can get FairMoney loan through its mobile app, and they offer flexible interest rates.

It is very easy to signing up for FairMoney, and you can also sign up using your Facebook account.

FairMoney loan requirement

To get a loan from FairMoney, below are the requirements;

1. Personal information: You will need to provide basic personal information such as your name and email address.

2. Bank Verification number (BVN): Your BVN is required to access FairMoney loan.

3. Bank Account Details: Your bank account details such as account name, and account number will be needed.

4. Automated Teller Machine card (ATM card): This will be needed because it will be used to debit you for loan repayment.

5. Photo of you: FairMoney will also need your picture (photo).

6. FairMoney App: You need to download FairMoney app because you can only apply for their loan from the app.

How to get a Loan from loan money

To get a loan from loan money, follow the steps below;

1. Download FairMoney app: The first step to get a loan through FairMoney is to download their app. You can only apply for loan through the app. The good news is that the app is available on Android.

Presently there is no iOS, Windows or Blackberry version of the app.

To download the app, go to Google Playstore on your Android phone or Click Here to download it right away.

2. Sign up: After downloading the app, the next step is to tap on it to sign up. You can sign up with your Facebook account to speed up the process.

3. Answer Some Questions: You need to answer some questions which would help the app to calculate a credit score.

If you pay back your loan on time, you will have access to bigger a loan offer.

4. Accept Loan Offer: Once you get a loan offer, all you have to do is to accept it.

5. Receive Loan: Once you have accepted the loan offer, you will receive the money right away.

Note: If your loan application is rejected, you can reapply after 15 days.

How much loan you can get from FairMoney

The amount you can get ranges from ₦1500 to ₦150,000. The exact amount depends on your credit score and other factors.

But if you always payback your loan on time, you will unlock more opportunities to get bigger funds.

FairMoney Loan Interest Rate

FairMoney has a flexible interest rate. The monthly interest rates range from 2% – 28%. The maximum annual APR is 13%.

Loan Repayment Duration

You can borrow money and pay back between 4 to 24 weeks.

Method of Loan Repayment

There are many options to repay loan. All you have to do is load money in your bank account, then open the app, click on payment and repay.

You can also repay through bank transfers or cash deposit with the following details;

Account Name: MyCredit

Account Number: 0023462495

Bank Name: Stanbic IBTC

Please use the code given in the app as your transfer reference, reason for transfer, remark or description.

Make sure that you contact the customer care before and after payment to inform them.

FairMoney Head Office

There is no office support at the money.

FairMoney customer care: The customer care email is help@fairmoney.ng

FairMoney App

The app is only available for Android phone. You can download it from the Google Playstore.